Unveiling the Mysteries of Credit Scores: How Algorithms Work

Credit scores are often shrouded in mystery, but unraveling these secrets is crucial for those aiming to achieve an outstanding score. Understanding how algorithms function is like obtaining the treasure map to financial stability.

At its core, a credit score is a number that reflects an individual’s reliability in handling credit. But how is this number calculated? Algorithms play a crucial role in this process, and grasping their workings is the key to improving your score.

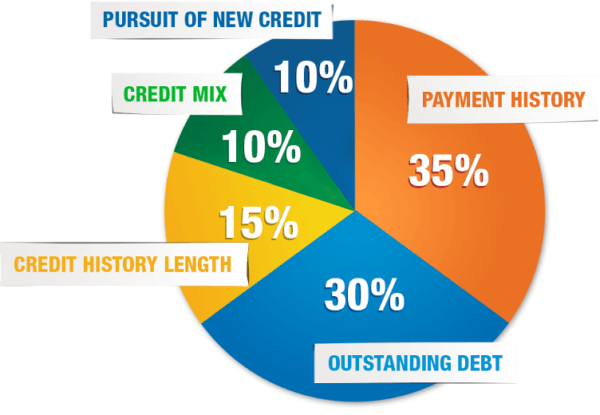

Major credit scoring models, such as FICO, take into account various factors to determine your score. Payment history is the most heavily weighted factor, representing 35% of the score. This means that paying bills on time is fundamental. A single late payment can result in a significant score drop.

The second most significant component is the amount owed, contributing 30%. This factor considers how much you owe in relation to your total credit limit. Keeping balances low on credit cards relative to the available limit is an effective strategy.

Credit history length, accounting for 15%, analyzes how long your accounts have been active. The longer the history, the better for your score. Credit mix diversity and the pursuit of new credit also factor into the equation, each with its share in the formula.

Understanding these components is the first step to optimizing your credit score. Algorithms are not magic; they are logical systems that reflect your financial practices. By unraveling them, you are on the right path to achieving a credit score that opens doors to financial opportunities.

The Role of Credit Cards: How to Keep Credit Utilization Low

Credit cards play a crucial role in determining credit scores, and understanding how to use them effectively is essential for maintaining a healthy score. The secret lies in balancing the benefit of available credit with financial responsibility, especially in keeping credit utilization low.

Credit utilization, or the credit used in relation to the available credit, represents a significant portion of the credit scoring formula, approximately 30%. Keeping this ratio low signals to creditors that you can manage your credit responsibly, positively contributing to your score.

The golden rule is to keep credit utilization below 30% of the available limit. For instance, if your total credit card limit is $10,000, ideally, you should not accumulate balances exceeding $3,000. This demonstrates financial moderation and can result in a higher credit score.

An effective strategy to keep credit utilization low is to make multiple payments throughout the month rather than waiting for the due date. This way, balances are kept low, even with regular card usage. This not only benefits your credit score but also avoids the accumulation of interest.

Additionally, considering requesting credit limit increases can contribute to reducing credit utilization. However, it is crucial not to view this as an excuse to increase spending but rather as a way to have more available space while maintaining financial discipline.

In summary, understanding the role of credit cards and how to keep credit utilization low are essential steps in building and preserving a strong credit score. By using credit wisely and moderately, credit cards can be valuable allies in the pursuit of lasting financial health.

The Importance of Diversity: How Credit Mix Influences Your Score

Credit score is like a financial recipe, and the diversity of credits plays a vital role in this mix. Understanding how the credit mix influences your score is essential for building a robust and versatile financial foundation.

The credit mix, accounting for 10% of the credit score, refers to the variety of credit types in your financial history. This includes mortgages, personal loans, credit cards, and other forms of financing. Diversity in this mix is interpreted by creditors as a sign of financial responsibility and the ability to handle different forms of credit.

By having a balanced combination of credits, you show creditors that you can manage various forms of financial obligations. This results in a more positive score, as it demonstrates a versatile ability to handle different aspects of credit.

However, it’s important to note that seeking credit diversity doesn’t mean applying for various loans or cards all at once. The approach should be organic and aligned with your actual financial needs. For example, if you’re planning to buy a house, including a mortgage in your history can be beneficial, provided it is managed responsibly.

Maintaining a controlled variety of credits over time also contributes to the length of credit history, another important factor in the score. As different types of accounts accumulate over the years, your credit history becomes more robust and enduring.

In summary, the importance of diversity in the credit mix should not be underestimated. Seeking a balanced variety of credit types over time not only contributes to a healthier credit score but also builds a solid financial foundation, paving the way for future opportunities and economic achievements.

Rebuilding Your Credit: Effective Strategies for Removing Negative Marks

Rebuilding your credit after facing financial challenges may seem like a daunting task, but effective strategies can help remove negative marks and pave the way for renewed financial health. Understanding how to deal with adverse information in your credit history is crucial to kickstart this recovery process.

The first crucial strategy is to thoroughly review your credit report. Identifying and understanding negative information, such as late payments, collections, or bankruptcies, allows you to craft a specific action plan. Knowing the extent of the damage is the first step to repairing it.

After this analysis, it’s time to dispute inaccurate or unfair information. Consumers have the right to dispute any item on their credit reports that they deem incorrect. This can be done through credit agencies, which are responsible for investigating and correcting any discrepancies.

Furthermore, negotiating with creditors can be an effective approach. In some cases, creditors may agree to remove negative information in exchange for a payment or a payment agreement. It’s crucial to document all agreements in writing to avoid future misunderstandings.

Establishing new financial habits is another key piece in credit rebuilding. Ensuring timely payments, avoiding excessive debt accumulation, and responsibly managing available credit are crucial steps to show creditors a positive change in financial behavior.

Remember that credit rebuilding is a gradual process that requires patience and consistency. As you implement these strategies, it’s important to regularly monitor your progress through updated credit reports. Over time, the removal of negative marks and the adoption of healthy financial habits can result in a revitalized credit score and new financial opportunities

DIY or Professional: Choosing the Best Approach to Repair Your Credit

When it comes to repairing your credit, the choice between a “do-it-yourself” (DIY) approach or seeking the help of professionals is a crucial decision. Each option has its own pros and cons, and understanding these nuances is essential to make an informed decision on improving your financial health.

The “do-it-yourself” approach offers the advantage of being more financially accessible. Many online resources and tools are available to help consumers understand the credit repair process and take action on their own. This includes disputing inaccurate information, establishing payment plans, and implementing healthier financial practices.

However, DIY requires time, patience, and a deep understanding of credit laws and practices. Those who opt for this approach should be prepared to dedicate consistent efforts over time.

On the other hand, seeking the help of credit repair professionals can offer convenience and specialized expertise. These services often involve professionals who understand the ins and outs of the credit system and have established relationships with creditors and credit agencies. They can take on the burden of the process, dealing directly with disputes and negotiations on behalf of the consumer.

However, professional assistance often comes with associated costs. Fees charged by credit repair services can vary and should be carefully weighed against potential benefits.

The choice between DIY and professional assistance depends on individual circumstances, including the severity of credit issues, available time, and willingness to engage in the process. Carefully assessing these factors will help determine the best approach to repairing your credit and achieving your long-term financial goals.